Subtrend

Packaging refreshes

A fresh coat of paint

Packaging refreshes are a lighter touch exercise than a formal rebrand. In this scenario, your brand—your story, positioning and messaging—are all good to go. You just want your packaging to work harder for you and need to address some more surface level issues.

Reasons for this are similar to rebrands, though maybe not as pressing. Inconsistency is a big one—you want to rein in and systemize your packaging across the board. Maybe you want to address the hierarchy between your brewery’s brand, beer names and style. Or you want to save money on production and decrease turnaround time for new releases. And sometimes, it’s just time for a new look.

If handled well, a package refresh can reap many of the same benefits as a rebrand (and at a much lower investment). So, if your team is thinking about a rebrand, revisit our thinking on Evolution vs. Revolution and make sure you understand which path is right for your business.

Packaging formats and production in flux

Dealing with the “Ball-out”

In late 2021, Ball dropped the unfortunate news that it was increasing its minimum order from one truckload (204,000) of cans to five truckloads (1,020,000 cans) per SKU.

For some context, something like 75% of breweries in the United States make less than 1,000bbl per year. The median brewer produces about ~400bbl per year). This isn’t even enough beer to put in one order of cans under this new pricing (let alone with just a single SKU). In other words, Ball’s decision effectively eliminates the ability of more than 90% of the beer industry to order painted cans (through them, anyway).

This lead to some last minute scrambling as breweries (including many of our own clients) worked to figure out where they were going to get cans over the next year.

I’m confident the industry will figure this out (I mean, look at what you’ve all survived over the last two years alone). It may be tough for a while, but there may be some interesting externalities and opportunities that that arise from this.

The first is that Ball’s decision dramatically affects any brewery who was planning to, or in the middle of transitioning from bottles to cans. These groups may need to reel that back in for a while until the can supply is sorted. (And maybe count themselves lucky that they didn’t sell that old bottling line just yet?) For what it’s worth, we haven’t had any clients get completely derailed by this, but it’s not too hard to imagine.

We’ll obviously see a lot more pressure sensitive and sleeved cans over the next few years, but beyond that, the second interesting thing at play here is that this may be the push that digitally-printed can companies need to become a more viable option. We’ve seen these groups at the Craft Brewers Conference and through our own work for a few years now, and I bet we’ll see more breweries use this technology, if not bring it in-house entirely, over the next few years.

Subtrend

Different formats for specific venues and occasions

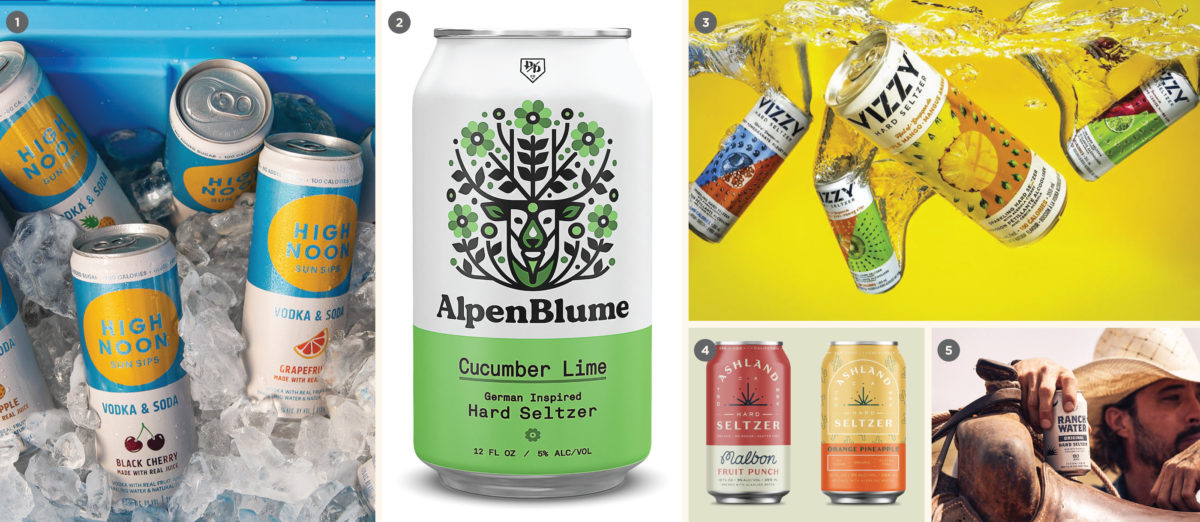

Chain retail vs. Bottle Shops vs. C-Stores vs. Large Venues

We’ve worked with older breweries and startups alike over the last year who were diversifying their packaging formats, often within the same brand.

Offering your beer in a few different formats is nothing new, but we’re seeing a wider array of formats intended to target different occasions and channels specifically. For example, a popular IPA brand might be put in 6-pack of 12oz cans, 4-pack of 16oz cans and 19.2oz cans. The latter two are there for single serve options, or maybe even signaling (in many markets, a beer isn’t craft unless it’s in a 16oz can). And the 12oz cans might be sold primarily through chain retail.

This was happening before the Ball announcement, but I imagine that it will accelerate diversification in packaging formats. We might even see bottles be (re)introduced into the mix.

Lifestyle brands go mainstream

Starting lean and laser focusing on your audience—so hot right now.

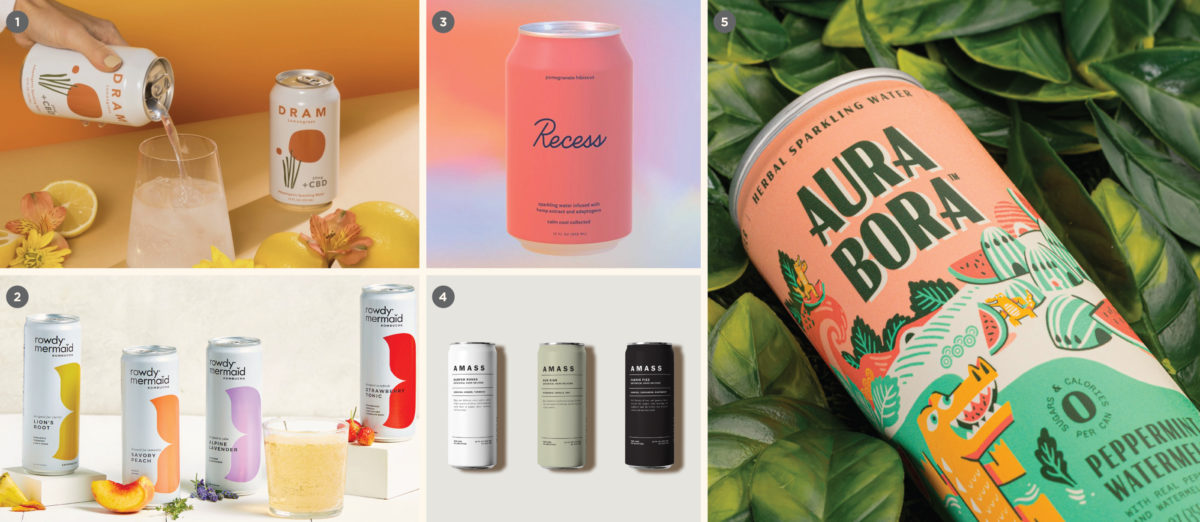

Pinning down a proper definition for what constitutes a lifestyle brand is challenging. It has to be part aspirational (i.e. by supporting this brand, you are embodying the values of and living some sort of desired lifestyle). It has to be hype-worthy (otherwise, people won’t line up to get it and brag when they finally do). But most importantly, it has to tap directly into a subculture.

What role does brand play in lifestyle positioning? Even more than any other non-lifestyle brand, I think the most telling feature is that the brand goes out of its way to embody a particular set of values so that the consumer can, by purchasing and interacting with the brand, signal that they too share those values. It allows your customers to signal in-group identification. In other words, I’m one of you guys. I’m cool too.

All brands inherently have values, but for a lifestyle brand, the values that the brand embodies are as important as the product for sale itself because it allows the consumer to find belonging. The thing you actually purchase is secondary to this end.

We’ve been trying to delineate between a regular old brand and a lifestyle brand for a few years and have determined that you just kind of know one when you see one. To wit, your average brewery probably isn’t a lifestyle brand (no matter how much cool merch they pump out). But if that local brewery targets a niche demographic that centers around a specific activity, interest, locale or specific ethos, then they may be headed in that direction.

We’ve received several inquiries from breweries in planning who wanted to make a lifestyle positioning play out of the gate over the last year, and with an ever increasingly competitive landscape, we think this can be a smart move. Paradoxically, it seems like lifestyle brands end up gaining more press and following the more narrowly they focus on their audience and sub culture.

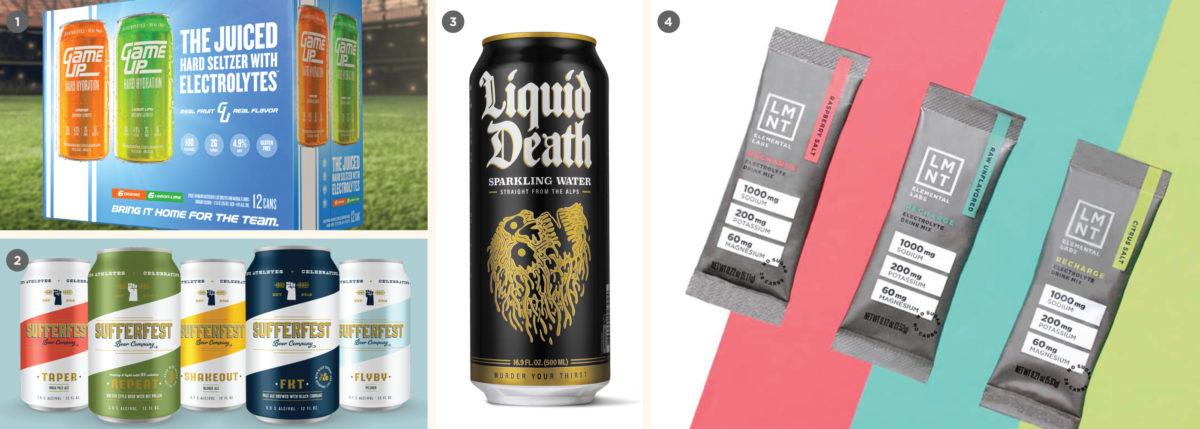

Here are a few prominent examples of well executed lifestyle brands:

If you’re a hipster cool, urban young professional, you drink PBR. Or increasingly, Hamm’s.

If you’re a skater / metal head who cares about the environment (and maybe sobriety?), you drink Liquid Death.

If you’re all about that Montana lifestyle, you shotgun Montucky Cold Snacks.

If you enjoy shooting guns, owning every lib in sight and drinking coffee, then there’s Black Rifle Coffee.

If you want to signal that you’re health conscious and conspicuously wealthy, you can plant your precious cheeks astride a Peloton.

If you want to signal that you’re outdoorsy, and only buy high quality adventure equipment that’s as durable as you are, then you grab a YETI Cooler.

A few observations about successful lifestyle brands

1. This isn’t always the case, but they tend to be digitally native to start (no brick and mortar location). For product brands (Pit Viper, Chubbie’s, Duke Cannon), this means you’re built primarily through digital ads and well-curated Instagram and TikTok channels. For breweries, this means you’re probably contract brewed.

2. They target a niche subculture exclusively. You need to speak your audience’s language (usually through memes) and values (through actions and charity support). And twirl on the haters ignore all outsiders—your group is the only one that matters. After all, not everyone can be your audience.

But paradoxically, it seems like lifestyle brands end up gaining more press and following the more narrowly they focus on their audience and sub culture. (this is likely due to a loud, overly-ardent fan base as much as it is brilliant marketing)

3. They create branded content and make it so compelling that people will watch hours of it despite knowing that they’re being advertised to. (e.g. YETI Presents).

4. They often use influencer marketing (or “Brand Ambassadors”) as a corner stone for scaling. This can be through social media, podcasts, even television and movies—wherever your audience consumes content. (still waiting on my phone call, Dasani…)

5. They use merchandise to foster in-group identification. They give people the tools they need to signal that they’re on board (and drive major revenue along the way).

6. They meet their people where they are. Field activation is key to making this all work. You need to be wherever your fans are—music venues, bars, tattoo parlors, barbershops, skate shops, conventions, sport venues, festivals, libraries, marathons, ski slopes, etc.

I think lifestyle brands will become an increasingly common strategy for launching new Bev Alc brands over the next several years. The ability to start lean and create something that speaks directly to a well-defined, ardent audience may be a safer bet than opening yet another taproom in a city full of taprooms.