Reason 2: The beer industry is facing major headwinds.

I don’t need to outline the myriad economic forces that are constricting the beer industry because you’re seeing this firsthand every day in your work. But for those who aren’t following along as closely, let’s just say that between a recession and inflation, lingering supply chain shortages and dramatically increased input costs, things aren’t looking so great right now.

So how can a brewery survive over the coming rocky years?

One way is to diversify your offerings.

It’s good practice to rebalance your investment portfolio every year to ensure you’re not overly-weighted in one asset class. This keeps you resilient and can minimize losses when things go sideways.

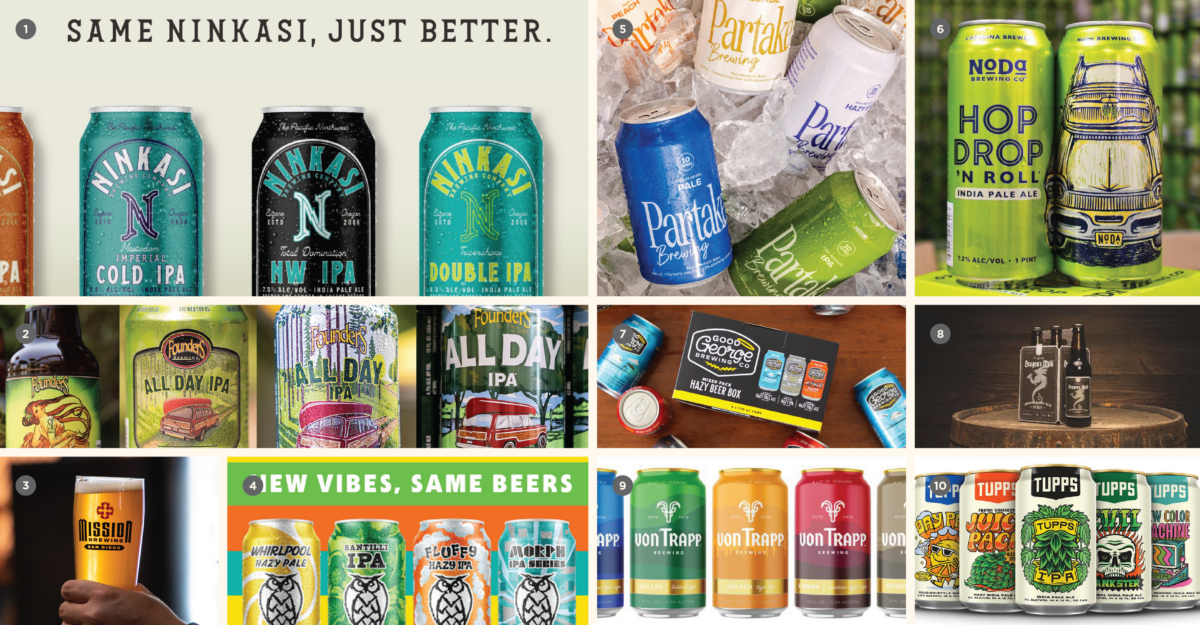

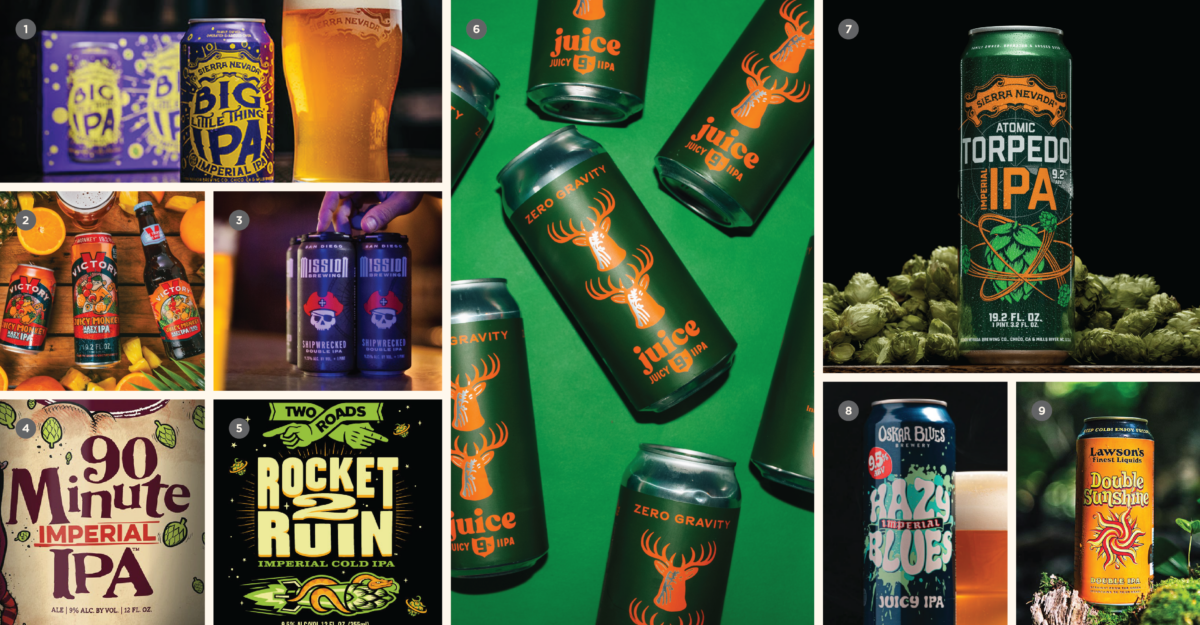

This concept applies to your brewery’s portfolio as well: By building a variety of brands and products across multiple categories that appeal to different audiences, price points and occasions, you can keep your business more robust as consumer preferences shift and broader economic constraints emerge.

We saw a lot of this from 2019 to 2022 in the form of breweries releasing hard seltzer and RTDs.

But this move is category agnostic.

For this conversation, we’re not drawing a line between beer or Beyond Beer products. Instead, we’re focusing on Sub Brands as a tool to leverage your parent brand to grow your overall portfolio.

Reason 3: Sub Brands create a smoother path to market than creating an entirely new brand.

Building a new brand is expensive. And it’s challenging. And it takes capacity (that you may not have). And to do it right, you have to invest as much time and energy and capital as you did when bringing your parent brand to market. In contrast, releasing a new brand that can come to market tied to your parent brand in some capacity can create a faster path towards driving trial and gaining mindshare.

I won’t go as far as to call this strategy a shortcut, but it is faster and cheaper to bring a new Sub Brand to market than creating an entirely new brand (one with no ties whatsoever to your parent brand).

Reason 4: Sub Brands are a platform for long term brand building.

We’ve written about the merits of Monolithic Portfolios vs. fanciful names and Sub Brands before. One thing that we’ve heard from our brewery clients is that Sub Brands give your customers one more point of reference to grab onto and to understand and bond with. Fernson Brewing mentioned this in our recent podcast conversation.

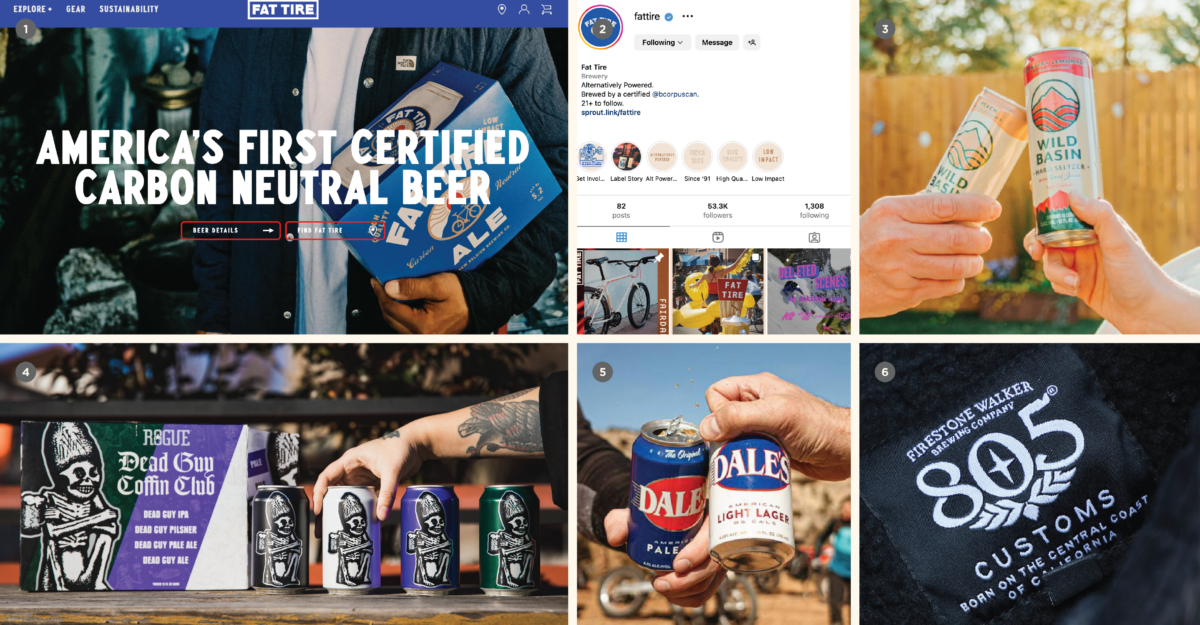

Think of the Bar Call heuristic. Someone walks into a bar and orders a beer: Which of these sounds (and feels) better?

“Give me a Firestone Walker Blonde Ale, please.”

or

“805, please.”

Welcome to the Era of Sub Brands (or, why Sub Brands are so hot right now)

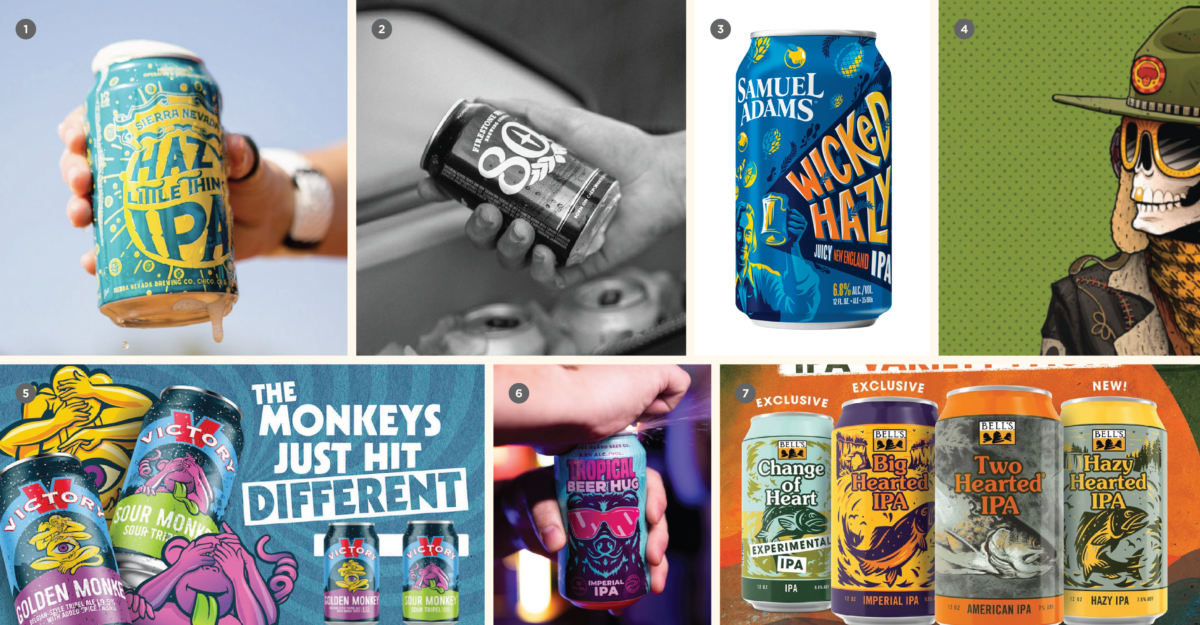

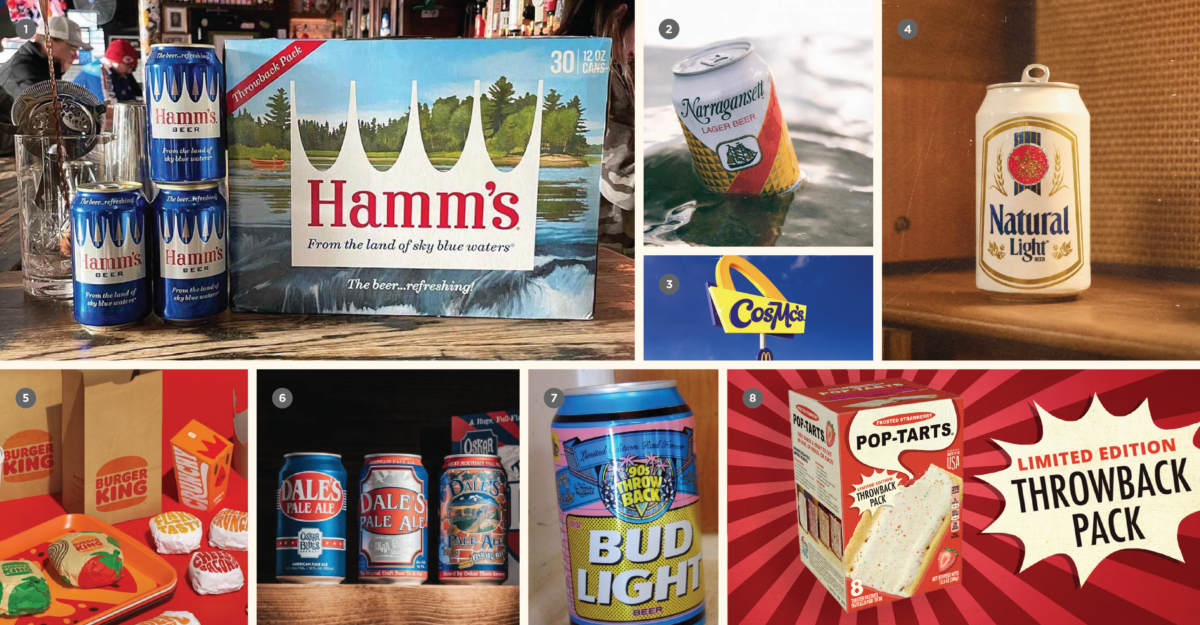

For the Legacy Brewery: Sub Brands are an opportunity to target a specific audience more credibly than you would be able to with your parent brand. You can bring to bear your entire scale (production, innovation, distribution, marketing, etc.) and launch a new brand more forcefully than a startup ever could.

For a newer, smaller brewery: Sub Brands are another chance to create something that resonates with your customers. And it creates a platform for future growth via Line Extensions, co-branding and a deeper universe you can flesh out over time.

For your customers: Sub Brands are an easy way to cut through the noise of today’s cold box and find a new go-to beer brand family that never lets them down.

How to Scale the “Sub Brand Ladder”

A step-by-step framework for building your Sub Brand

Your brewery’s Brand Architecture isn’t a static thing. Similar to your Brand Strategy and brand itself, you should revisited it as needed—whenever you’re planning to launch a new product, or setting annual goals, working through your ABP, doing some spring cleaning, and so on.

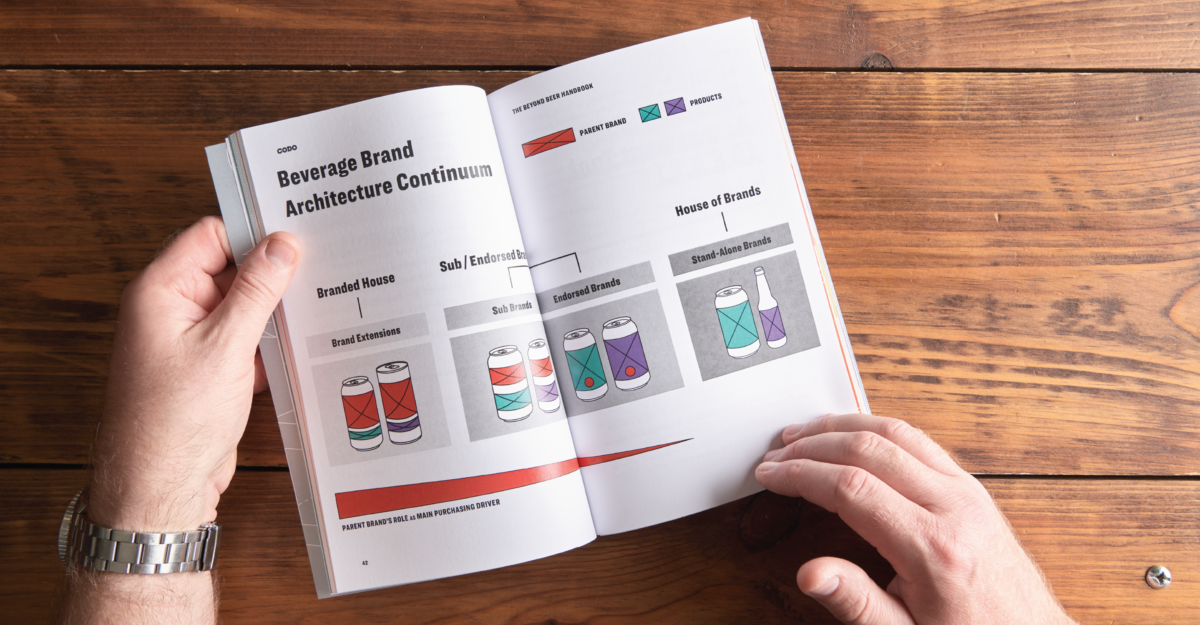

This applies to your overarching Brand Architecture as well as at the individual product level—no brand in your portfolio has to fly under the same strategy forever. Overtime, as a brand grows in prominence, it will naturally start to slide more rightward on the Continuum.

This is a concept we call “scaling up and down” the Beverage Brand Architecture Continuum.

The Sub Brand Ladder concept narrows our focus on this evolution to the middle of the Continuum, as you scale your new product (to, or) from Sub Brand to Endorsed Brand and beyond.

Some of the ideas we outline below don’t fit neatly into one stage vs. another. And if you talk with two breweries who have built successful Sub Brands, you’ll find that they’ve taken very different, circuitous (if not serendipitous) paths to get to where they are today.

So don’t get too hung up on whether you need to complete everything in the middle rungs before moving on to the top rungs, etc.

Think of this less as a punch list and more as a tool box you can sift through and select from as you build your Sub Brand.

First steps: Creating a platform

So you’ve decided to build a Sub Brand. (Nice!)

At the earliest stages of this process, you are building a platform for future brand building work. So you don’t have to create a perfect plan (and besides, your plan will inevitably shift given how fast industry and consumer trends evolve today).

It’s important to note that the following items on their own don’t make your beer a Sub Brand. But you cannot build a fully-formed Sub Brand without them. (e.g., all Sub Brands have a fanciful name, but not all fancifully-named beers are Sub Brands.)

Some things you’ll need at the first rungs of the ladder include:

1. Develop a fanciful name.

Your Sub / Endorsed Brand will need a compelling name. This can be as important as your parent brand itself name, so don’t shortcut this process. Learn how to develop a great brewery name here.

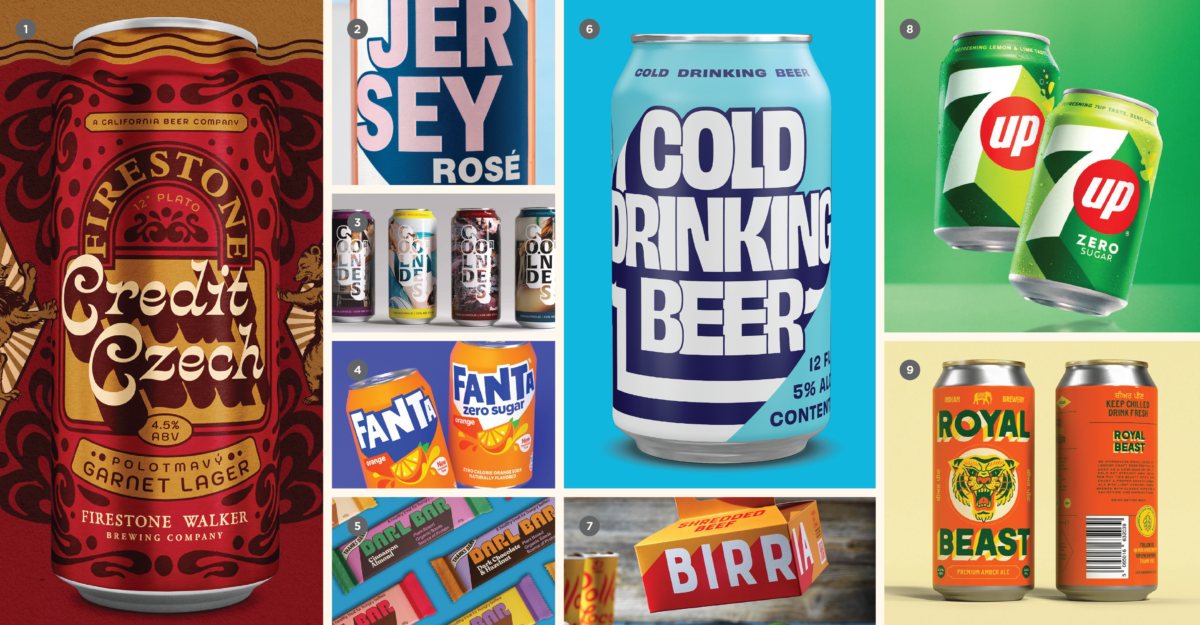

2. Determine your Brand Architecture strategy & develop differentiated aesthetics.

Once you’ve established a compelling name, you’ll need to decide whether you want to initially position this brand as a Sub or Endorsed model. (Take our B.E.A.T. Assessment to quickly orient yourself here.)

Once you’ve made that decision, you’ll need to flesh out the brand’s look and feel. The level to which you do this will depend on whether you’re launching a Sub Brand or an Endorsed Brand to start. To wit, a Sub Brand will be closely tied to your parent brand, whereas an Endorsed Brand will stand more on its own out of the gate.

In either case, you will need to establish some level of Brand Identity for this new brand.

3. Build a rough plan for how you intend to scale the brand.

How do you want to develop this brand? Do you envision entering multiple categories, or staying nimble and focusing on a limited number of products? Does it make sense to (eventually) scale through Line and/or Brand Extensions?

Fast forward 5 years: What does this Sub Brand look like? And how does this compare with the rest of your business?

Your Brand Strategy will evolve over time so I wouldn’t worry about getting it perfect at this stage. But roughly charting out how you want the Sub Brand to relate to your parent brand and a few initial ways you think you can help the brand achieve velocity is a good place to start.